TRADING Services

Join our PAMM account and get consistent monthly passive income. We accept account size up to $100M

Since 2011

PAMM ACCOUNT. Akron, Ohio Since 2011

We are a group of private traders with 11+ Years of consistency in the financial markets. Throughout this period we have been able to help thousands of struggling traders to make money profitably through the crucial Knowledge we impart and signals we provide. This time, we are delighted to publicly announce our PAMM account.

Pricing

PAMM Account Price

*We accept account sizes up to $100M!

Personal

- Monthly fee

- Up to $1M Account Size

- 30%/m profit commission

- 8% – 16% monthly

- 10% max dd

- $20M+ Under Management

- 24/7 Support

- 30 days risk free guarantee

Deluxe

- Monthly fee

- $1M – $10M account size

- 30%/m profit commission

- 8% – 16% monthly

- 10% max dd

- 20M+ Under Management

- 24/7 Support

- 30 days risk free guarantee

Pro

- Monthly fee

- $10M – $50M account size

- 30%/m profit commission

- 8% – 16% monthly

- 10% max dd

- 20M+ Under Management

- 24/7 Support

- 30 days risk free guarantee

Enterprise

- Monthly fee

- $50M – $100M account size

- 30%/m profit commission

- 8% – 16% monthly

- 10% max dd

- 20M+ Under Management

- 24/7 Support

- 30 days risk free guarantee

Having problem with payment?

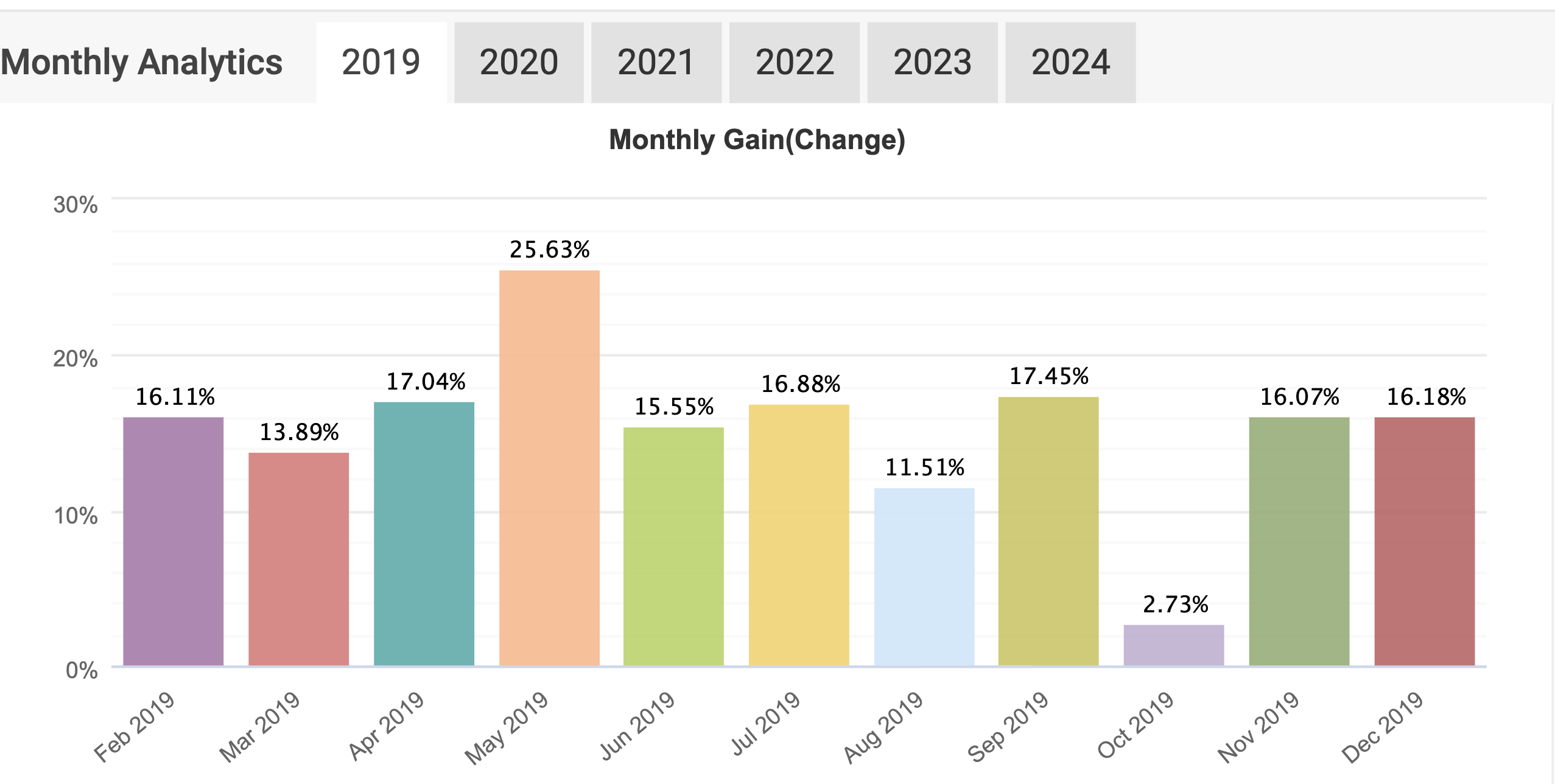

RETURNS

PAMM Account Returns

2019 February: 16.11%

2019 March: 13.89%

2019 April: 17.04%

2019 May: 25.63%

2019 June: 16.88%

2019 July: 11.51%

2019 August: 2.73%

2019 September: 17.45%

2019 October: 2.73%

2019 November: 16.07%

2019 December: 16.18%

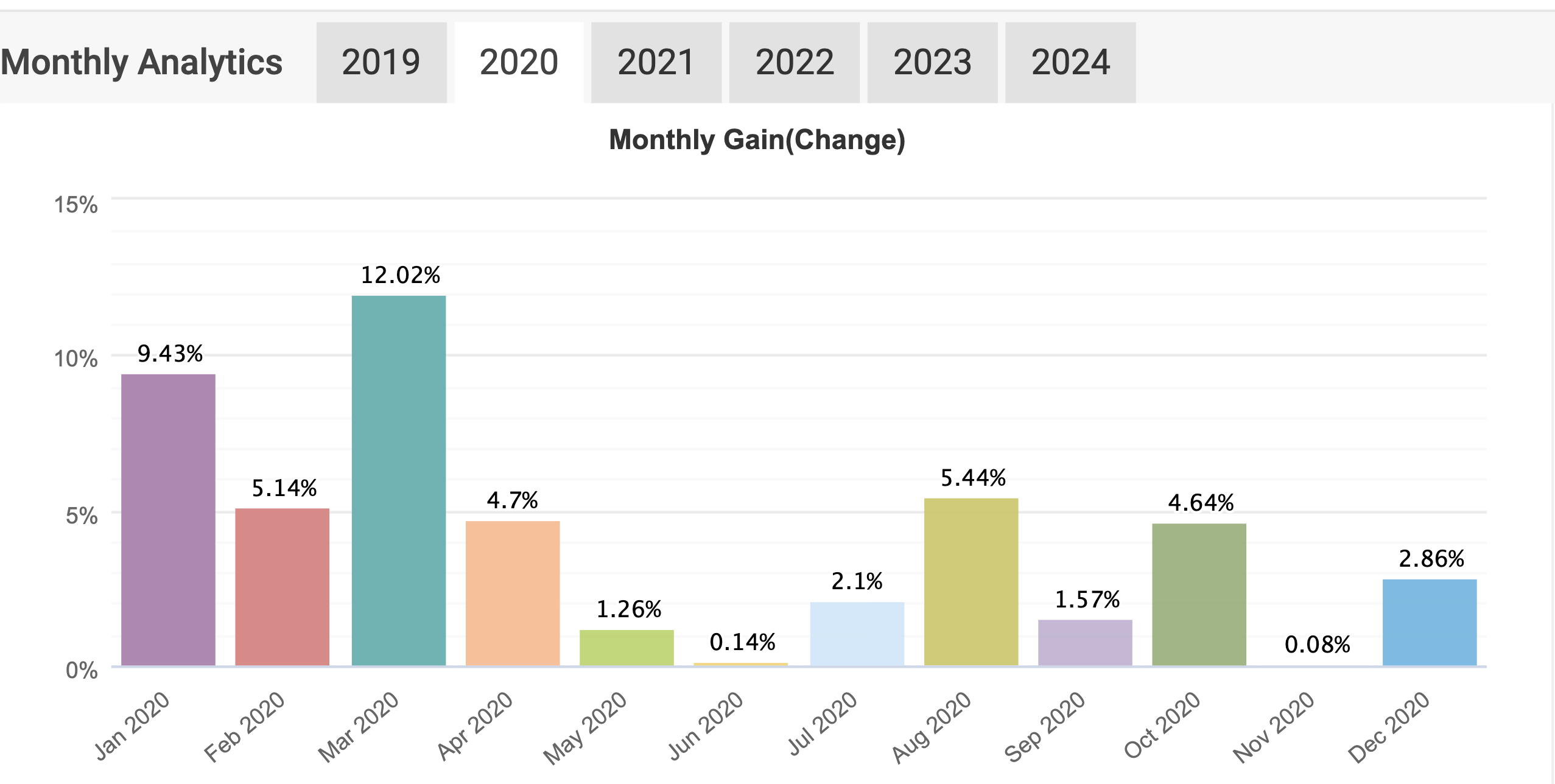

2020 January: 9.43%

2020 February: 5.14%

2020 March: 12.02%

2020 April: 4.7%

2020 May: 1.26%

2020 June: 0.14%

2020 July: 2.1%

2020 August: 5.44%

2020 September: 1.57%

2020 October: 4.64%

2020 November: 0.08%

2020 December: 2.86%

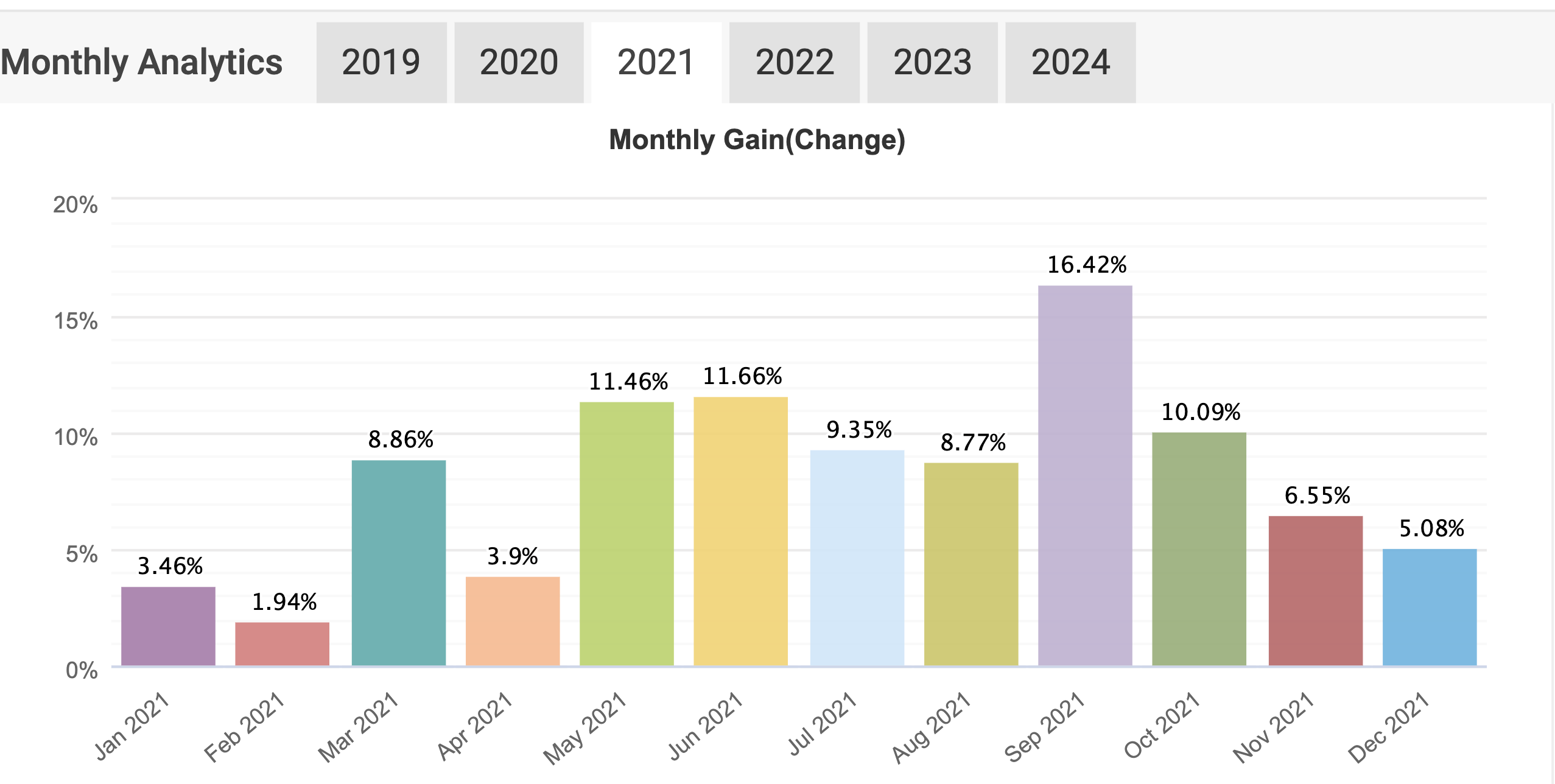

2021 January: 3.46%

2021 February: 1.94%

2021 March: 8.86%

2021 April: 3.9%

2021 May: 11.46%

2021 June: 11.66%

2021 July: 9.35%

2021 August: 8.77%

2021 September: 16.42%

2021 October: 10.09%

2021 November: 6.55%

2021 December: 5.08%

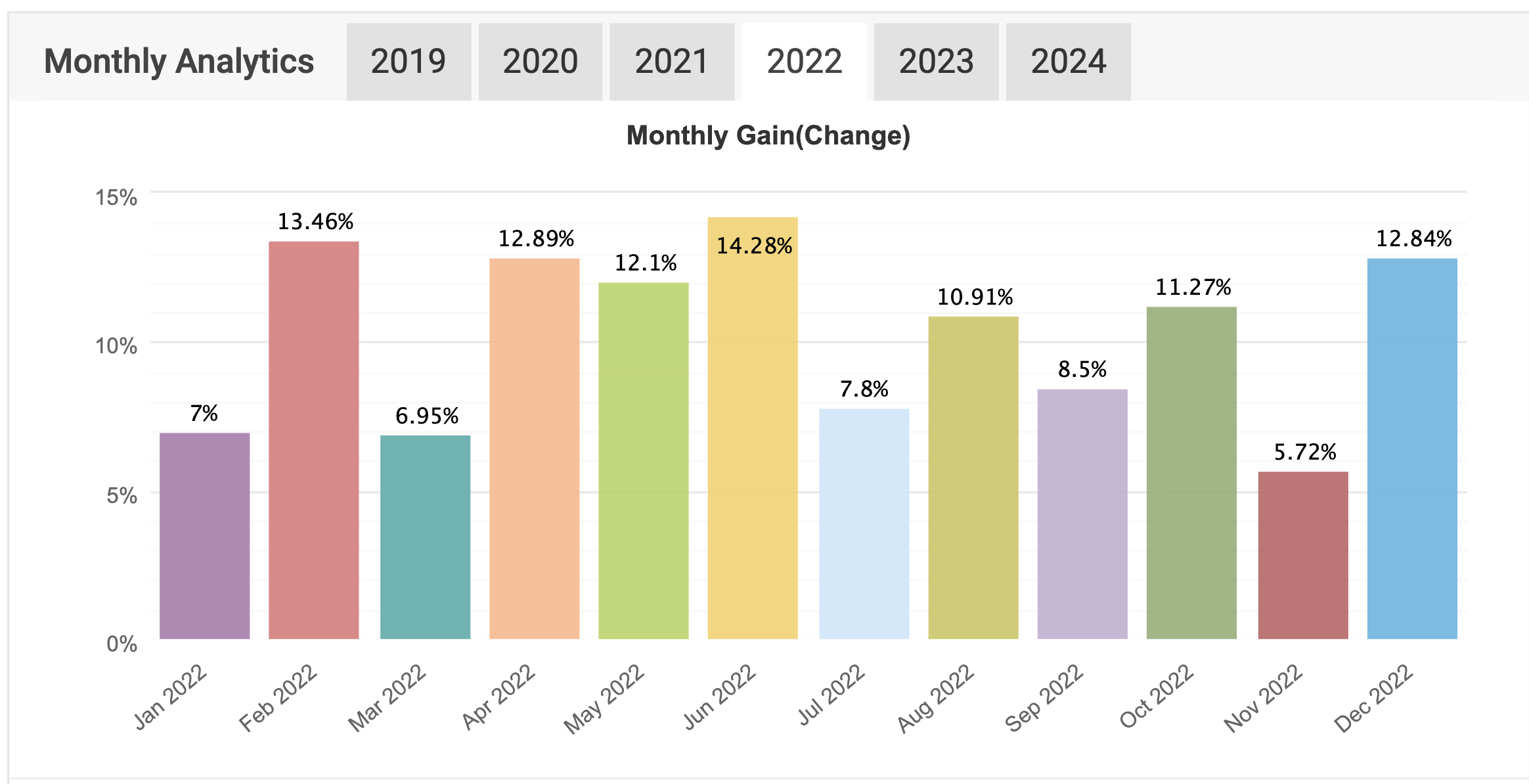

2022 January: 7%

2022 February: 13.46%

2022 March: 6.95%

2022 April: 12.89%

2022 May: 12.1%

2022 June: 14.28%

2022 July: 7.8%

2022 August: 10.91%

2022 September: 8.5%

2022 October: 11.27%

2022 November: 5.72%

2022 December: 12.84%

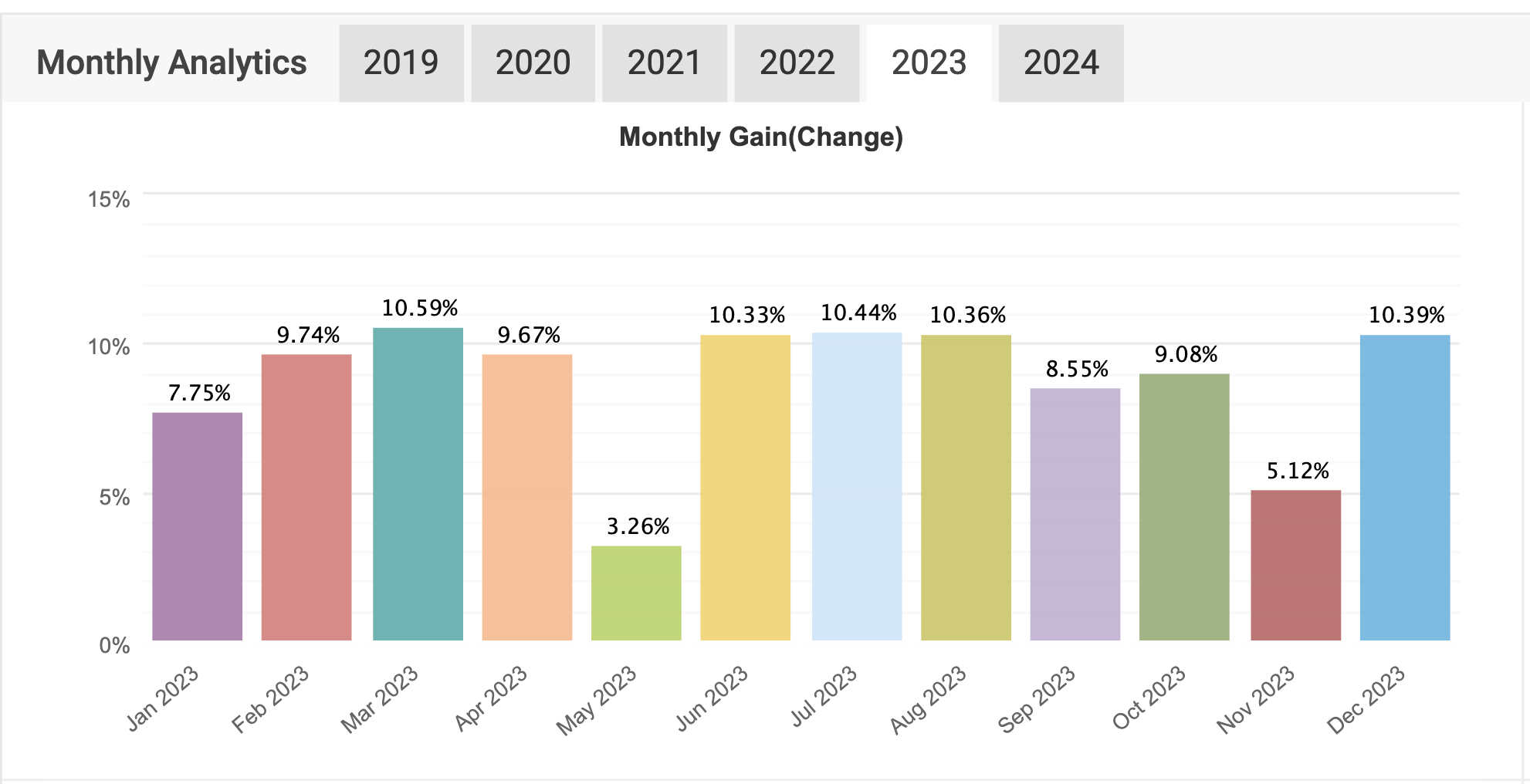

2023 January: 7.75%

2023 February: 9.74%

2023 March: 10.59%

2023 April: 9.67%

2023 May: 3.26%

2023 June: 10.33%

2023 July: 10.44%

2023 August: 10.36%

2023 September: 8.55%

2023 October: 9.08%

2023 November: 5.12%

2023 December: 10.39%

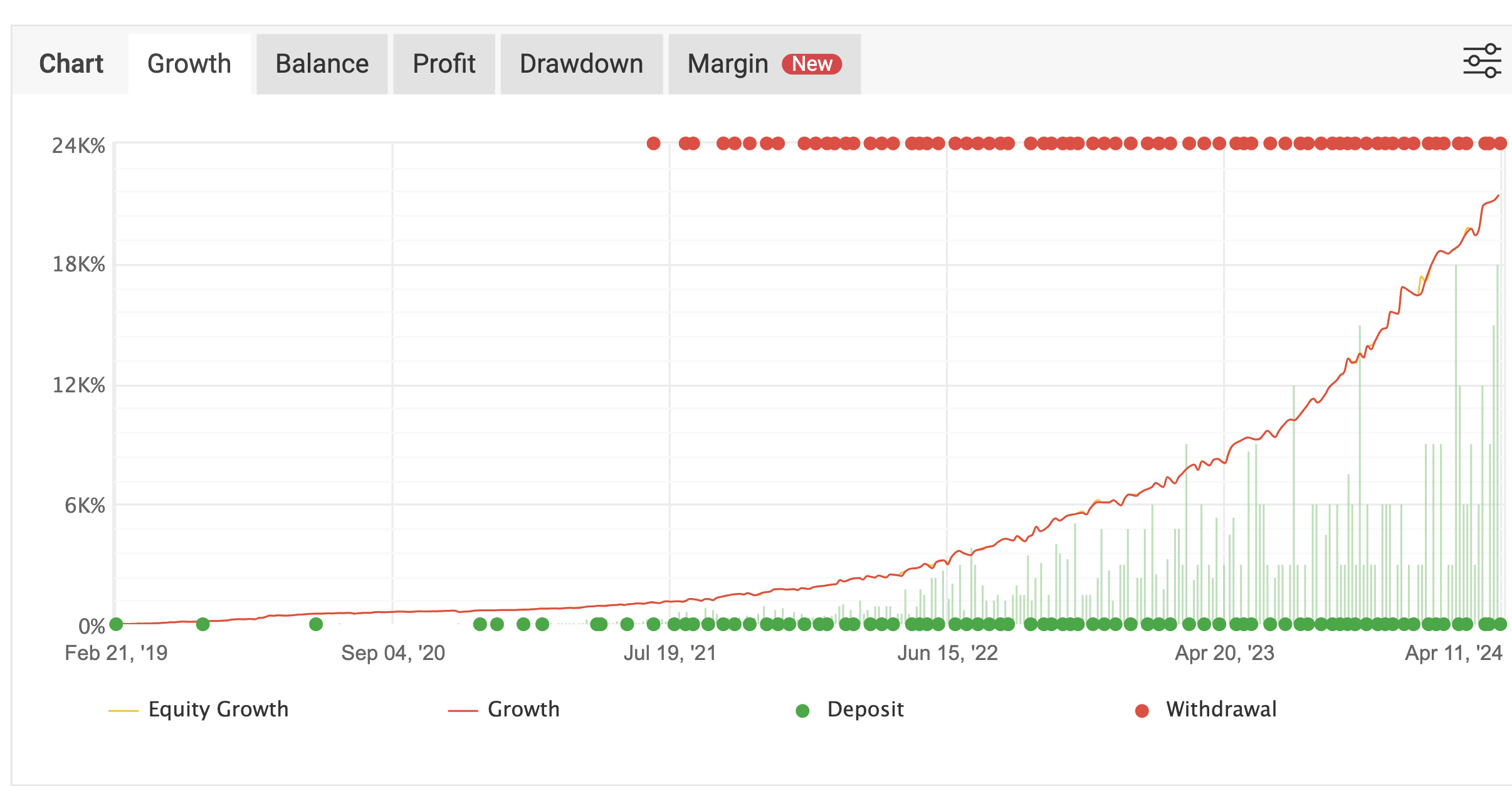

Join our PAMM account management service. Leverage on our 11+ years of experience from only $47 per month.

OUR PRO TRADERS: HOLLY DISCUSSES HER JOURNEY WITH FTMO | OVER $1.2M TOTAL WITHDRAWALS

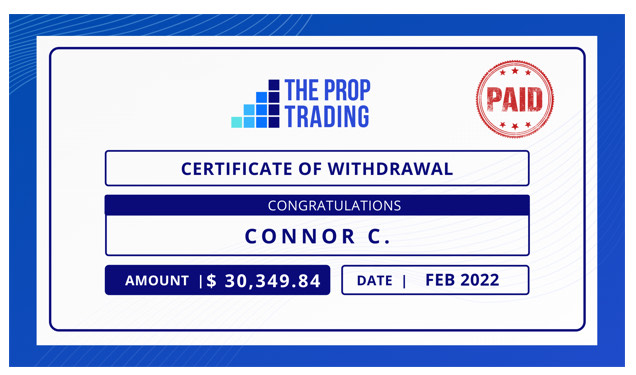

OUR TESTIMONIAL: CONNOR SHARES HER $30K WITHDRAWAL EXPERIENCE ON QUORA | OVER $150K TOTAL WITHDRAWALS

CORE VALUES

We are proud Traders with 11+ Years of consistent experience in the financial markets.

Our company consists of 42 professional, experienced and profitable traders who execute trades MANUALLY using various strategies based on pure price action and smart money concepts.

Leverage

Corporate

Consistency

Scalable

software edge

PAMM ACCOUNT

PAMM ACCOUNT MANAGEMENT

Chat with an online support and let us know the account size to be traded. Our Dedicated Team of Traders is available to start trading your evaluation.

Prop Firm Trading

We can help you trade the account, feel free to get in touch with us.

White label prop firm

Are you an investor looking to get into the prop firm business, we can setup a whitelabel prop firm company for you at an affordable budget within $100k- $150k. Get in touch with us to learn more.

Crypto arbitrage

Commercial crypto Market making

Crypto market making involves providing liquidity on a defined cryptocurrency by submitting both bid and ask limit orders on a crypto exchange. Market makers make a profit by collecting the bid-ask spread over multiple trades.What is a PAMM Account?

leverage

consistency

scalable

Software edge

PAMM trading accounts allow traders to pool funds and invest in financial markets. This account gives investors more trading options and the potential to earn higher returns. It includes automated trading systems, risk management tools, and advanced analytics & reporting. Traders who want more flexibility and control in their investments should consider a PAMM account.

Trading on small accounts with the hope of doubling or tripling the account, which ends up blowing due to aggressive trading style, is why the majority of retail traders do not achieve success in trading after several years of suffering on blowing accounts.

WHY CHOOSE OUR PAMM ACCOUNT

Winning Strategy

Passed EvaluatioNs

Over the past few years, we have passed more than 2,000 evaluations for our esteemed clients from various prop trading firms. Satisfying our clients was, is, and always will be our topmost priority.

Passive Income

Profit Assurance

Financial Freedom

We aim for 8 – 16% gain every month on all account sizes. Our profit split rate is 30% of the total profit figure whereas account owner you remain with 70%.

Committed Team

F.A.Q.

How can i contact you?

Use the 24/7 available live chat on telegram to contact us, our average response time is 5 minutes.

How Does a PAMM Account Work?

In a PAMM trading account, individual investors deposit their funds into a single trading account, creating a combined pool of capital. This pooled capital is then managed by a professional trader, or a fund manager known as the PAMM Account Manager. The fund manager’s role is to execute trades and make investment decisions on behalf of all the investors in the PAMM account.

Investors’ contributions are represented by a percentage of the total capital in the account. Any profits or losses generated from the trades are distributed proportionally to each investor based on their share in the account. PAMM accounts offer investors the opportunity to participate in the financial markets while benefiting from the expertise of a skilled trader, without the need to actively manage their own trades.

For traders, acting as PAMM Account Managers can be advantageous as well. By managing the pooled capital, they can make larger trades, potentially leading to higher profits. Additionally, PAMM Account Managers may charge a performance fee based on the profits earned, incentivising them to generate positive returns for the investors.

Here’s how PAMM accounts work and what investors and traders need to know.

How does a PAMM account work in a PAMM solution

PAMM accounts are designed to enable investors to benefit from the expertise of a professional trader or money manager without having to actively manage their investments themselves.

Here’s a step-by-step illustration of how PAMM accounts work.

The investor signs up for a PAMM account with a forex broker

PAMM accounts are offered by online forex brokers, so the first thing an investor should do is to sign up with a forex broker and open a PAMM account.

The investor deposits funds

After opening a PAMM account, the investor deposits their own funds into the PAMM trading account. The minimum deposit required may vary by broker, but many brokers offer low minimum deposits to make PAMM accounts accessible to a wider range of investors.

The investor selects a trader or account manager

Once the funds have been deposited, the investor can select a trader or a team of traders to manage their funds. Appointed traders are known as Account Managers or Investment Managers.

When selecting an Investment Manager, the investor should carefully evaluate the traders available for the PAMM account, considering their performance history, investment strategy, fees, and other factors.

The trader’s track record and investment approach should align with the investor’s investment objectives and risk tolerance.

The trader manages the investment

Once appointed as the Investment Manager, the trader is responsible for making investment decisions on behalf of the investor. Note that several investors can appoint the same PAMM Manager. The investment manager can also handle several PAMM accounts at the same time to manage different investment strategies

How are profits and losses distributed in a PAMM Account?

Assuming there are three investors – Allen, Billy and Chen – who want to make use of a PAMM solution to trade on the forex market. The below example is used for educational purposes only.

They sign up with a forex broker and open a PAMM account each.

Ted is an experienced forex trader who wants to increase his potential earnings from successful forex trades. He signs up as a PAMM Investment Manager, and is selected by Allen, Billy and Chen to trade on their behalf.

The four of them pool their money together, and the funds are invested and managed by Ted.

Here’s how much each of them invests:

Allen: $10,000

Billy: $25,000

Chen: $15,000

Ted: $50,000

The total investment amount is thus $100,000. Ted charges a performance fee of 10% of the profit.

After the first round of investment, a 20% gain was achieved, which equals a profit of $20,000.

Before profits are distributed, the performance fee is deducted – in this case $2,000 (10% of $20,000). The remaining $18,000 is then redistributed to all participants in the pool.

What fees are charged in a PAMM account?

The performance fee charged by the Investment Manager isn’t the only fee that investors may have to pay. There are other fees such as deposit fees, withdrawal fees, and management fees to be charged.

PAMM accounts are only offered by online brokers, who screen and select professional traders with proven track records to act as PAMM Investment Managers. Brokers also host the structure and trading platforms required by the PAMM account.

As such, it is customary for brokers to charge a fee for providing PAMM accounts. However, this may not take the form of an overt account fee, and may instead be bundled into trading commissions, spreads and other charges.

Are PAMM accounts legal

Yes, PAMM accounts are legal in most countries; however, their safety can vary depending on several factors.

To ensure a secure investment experience, it is crucial to select a reputable and regulated forex broker that offers PAMM services. By doing so, investors can mitigate potential risks associated with PAMM accounts and enjoy the benefits of professional money management.

The Bottom Line: How Does a PAMM Account Work?

Signing up for a PAMM account allows investors to potentially take advantage from the forex market by tapping on the experience, knowledge and strategies of professional traders.

Traders who are selected as PAMM Investment Managers can access a larger pool of funds to trade with, facilitating a wider variety of trades and amplifying their trading results. They are also entitled to earn a performance fee on profitable trades, further boosting their earnings from the forex market.