Contact

Get In Touch

F.A.Q.

How can i contact you?

Use the 24/7 available live chat on telegram to contact us, our average response time is 5 minutes.

How Does a PAMM Account Work?

In a PAMM trading account, individual investors deposit their funds into a single trading account, creating a combined pool of capital. This pooled capital is then managed by a professional trader, or a fund manager known as the PAMM Account Manager. The fund manager’s role is to execute trades and make investment decisions on behalf of all the investors in the PAMM account.

Investors’ contributions are represented by a percentage of the total capital in the account. Any profits or losses generated from the trades are distributed proportionally to each investor based on their share in the account. PAMM accounts offer investors the opportunity to participate in the financial markets while benefiting from the expertise of a skilled trader, without the need to actively manage their own trades.

For traders, acting as PAMM Account Managers can be advantageous as well. By managing the pooled capital, they can make larger trades, potentially leading to higher profits. Additionally, PAMM Account Managers may charge a performance fee based on the profits earned, incentivising them to generate positive returns for the investors.

Here’s how PAMM accounts work and what investors and traders need to know.

How does a PAMM account work in a PAMM solution

PAMM accounts are designed to enable investors to benefit from the expertise of a professional trader or money manager without having to actively manage their investments themselves.

Here’s a step-by-step illustration of how PAMM accounts work.

The investor signs up for a PAMM account with a forex broker

PAMM accounts are offered by online forex brokers, so the first thing an investor should do is to sign up with a forex broker and open a PAMM account.

The investor deposits funds

After opening a PAMM account, the investor deposits their own funds into the PAMM trading account. The minimum deposit required may vary by broker, but many brokers offer low minimum deposits to make PAMM accounts accessible to a wider range of investors.

The investor selects a trader or account manager

Once the funds have been deposited, the investor can select a trader or a team of traders to manage their funds. Appointed traders are known as Account Managers or Investment Managers.

When selecting an Investment Manager, the investor should carefully evaluate the traders available for the PAMM account, considering their performance history, investment strategy, fees, and other factors.

The trader’s track record and investment approach should align with the investor’s investment objectives and risk tolerance.

The trader manages the investment

Once appointed as the Investment Manager, the trader is responsible for making investment decisions on behalf of the investor. Note that several investors can appoint the same PAMM Manager. The investment manager can also handle several PAMM accounts at the same time to manage different investment strategies

How are profits and losses distributed in a PAMM Account?

Assuming there are three investors – Allen, Billy and Chen – who want to make use of a PAMM solution to trade on the forex market. The below example is used for educational purposes only.

They sign up with a forex broker and open a PAMM account each.

Ted is an experienced forex trader who wants to increase his potential earnings from successful forex trades. He signs up as a PAMM Investment Manager, and is selected by Allen, Billy and Chen to trade on their behalf.

The four of them pool their money together, and the funds are invested and managed by Ted.

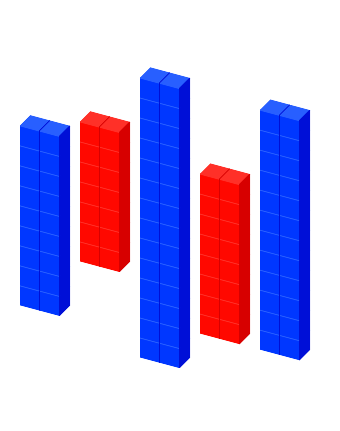

Here’s how much each of them invests:

Allen: $10,000

Billy: $25,000

Chen: $15,000

Ted: $50,000

The total investment amount is thus $100,000. Ted charges a performance fee of 10% of the profit.

After the first round of investment, a 20% gain was achieved, which equals a profit of $20,000.

Before profits are distributed, the performance fee is deducted – in this case $2,000 (10% of $20,000). The remaining $18,000 is then redistributed to all participants in the pool.

What fees are charged in a PAMM account?

The performance fee charged by the Investment Manager isn’t the only fee that investors may have to pay. There are other fees such as deposit fees, withdrawal fees, and management fees to be charged.

PAMM accounts are only offered by online brokers, who screen and select professional traders with proven track records to act as PAMM Investment Managers. Brokers also host the structure and trading platforms required by the PAMM account.

As such, it is customary for brokers to charge a fee for providing PAMM accounts. However, this may not take the form of an overt account fee, and may instead be bundled into trading commissions, spreads and other charges.

Are PAMM accounts legal

Yes, PAMM accounts are legal in most countries; however, their safety can vary depending on several factors.

To ensure a secure investment experience, it is crucial to select a reputable and regulated forex broker that offers PAMM services. By doing so, investors can mitigate potential risks associated with PAMM accounts and enjoy the benefits of professional money management.

The Bottom Line: How Does a PAMM Account Work?

Signing up for a PAMM account allows investors to potentially take advantage from the forex market by tapping on the experience, knowledge and strategies of professional traders.

Traders who are selected as PAMM Investment Managers can access a larger pool of funds to trade with, facilitating a wider variety of trades and amplifying their trading results. They are also entitled to earn a performance fee on profitable trades, further boosting their earnings from the forex market.